Emerging markets revisited: A window of opportunity for patient capital

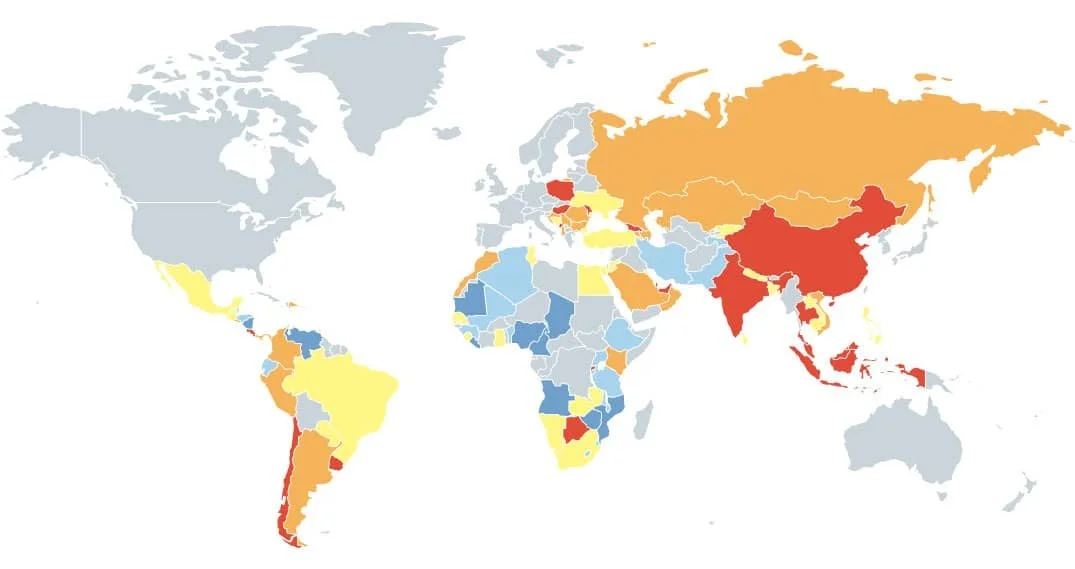

Every few years, global investors rediscover the so-called “emerging markets.” It’s a term that often gets thrown around to describe a diverse group of countries, from Brazil to India, from Kenya to Vietnam, all at different stages of development but sharing one thing in common: potential. And yet, many still hesitate.

For some, the words emerging market bring to mind volatility, political risk, or past disappointments. That hesitation is understandable. But in 2025, there’s a quiet shift taking place, one that deserves a second look.

Why Investors Are Paying Attention Again

Over the past year, we’ve seen money begin to move out of the most expensive markets, particularly the U.S., and flow into regions where growth is stronger and prices make more sense. Many of these countries have been quietly doing the hard work of reform and rebuilding, even when global attention was elsewhere.

Take India, where the government has invested heavily in digital infrastructure and manufacturing capacity, making it one of the most dynamic economies in the world today. Or Indonesia, which has steadily improved its fiscal discipline while positioning itself as a key player in the battery metals supply chain.

Closer to home, Kenya has strengthened its digital payments and financial systems, Ghana is restoring confidence after a challenging debt restructuring, and Rwanda continues to impress with governance and business-friendly reforms that attract regional investment.

These are not isolated stories. They show what’s possible when leadership, regulation, and long-term planning align, the building blocks of economic resilience.

Why This Moment Feels Different

Several forces are shaping this new chapter,

Better Value: After years of high returns in developed markets, many assets there now look expensive. Emerging economies, though still risky, offer growth at more reasonable prices.

Youthful Populations: Regions like Africa and South Asia have some of the youngest workforces on earth. That means decades of potential productivity, innovation, and consumption ahead.

A Changing Global Economy: As the world shifts toward clean energy and new technologies, resource-rich and digitally ambitious nations are gaining strategic importance.

None of this guarantees smooth sailing. But it does mean the story of “emerging markets” is broader, and brighter, than many assume.

Understanding the Risks

swing, and global capital can be fickle. Some reforms stall, others succeed unevenly.

That’s why it’s crucial to look at each country individually, to understand not just the numbers, but the people and policies behind them. Investing in these markets isn’t about chasing short-term gains, it’s about partnering with regions that are building the foundations of long-term prosperity.

Africa’s Growing Role

Across Africa, there’s a quiet but steady evolution underway. In cities like Nairobi, Lagos, Kigali, and Accra, entrepreneurs, builders, and policymakers are shaping economies that are younger, more connected, and more ambitious than ever.

Kigali Innovation City

Digital transformation is redefining how Africans work, trade, and save.

Urbanisation is driving new demand for housing, transport, and sustainable infrastructure.

Natural resources such as lithium in Zimbabwe and platinum in South Africa are key to the global energy transition.

Yes, challenges remain, governance gaps, infrastructure bottlenecks, and climate vulnerability. But where others see risk, patient investors see opportunity, the kind that unfolds over decades, not days.

The Case for Patience

The most successful investors in emerging markets aren’t those who time the next rally. They’re the ones who understand that real value takes time to compound.

Patience allows capital to become partnership, the kind that helps businesses grow, communities thrive, and wealth endure across generations. For families, institutions, and entrepreneurs thinking about the future, this mindset can turn volatility into opportunity.

At JA Group, we call that purpose-driven prosperity, aligning wealth with meaning and capital with contribution.

What Kind of Investor Do You Want to Be?

So, are emerging markets, or let’s just say “the world’s fast-growing economies,” an opportunity or a mirage? The truth lies somewhere in between. They are not a shortcut to quick gains, nor a mirage destined to disappear. They are a journey, one that rewards those who think long term, act responsibly, and stay grounded when others chase headlines.

For investors willing to take that journey, the years ahead may offer more than financial return. They may offer the satisfaction of being part of something larger, a shared story of growth, innovation, and resilience across the world’s most promising frontiers.

“The future belongs to those who can look past the noise and invest with conviction.”

To explore how JA Group helps clients align long-term opportunity with disciplined strategy, connect with our advisory team.