Overcoming recency bias: The investor’s mental trap door

When markets rise or fall, it’s natural for us to focus on what just happened. But if we give too much weight to the latest headlines and forget the bigger picture, we risk falling into a common mental trap: recency bias.

This bias makes us believe that what has happened most recently will keep happening, even when history tells us otherwise. It’s one of the most powerful forces shaping investor behavior, often leading people to buy at market highs, sell in panic, and miss the long-term opportunities that build real wealth.

Why Do We Fall for Recency Bias?

Our brains are wired for survival. We pay attention to the newest threat or opportunity because, in the past, that helped us stay alive. But in investing, this instinct often works against us.

Think about it:

If the market has been falling for months, we assume the worst is still to come.

If a sector has just delivered huge returns, we believe it will keep outperforming forever.

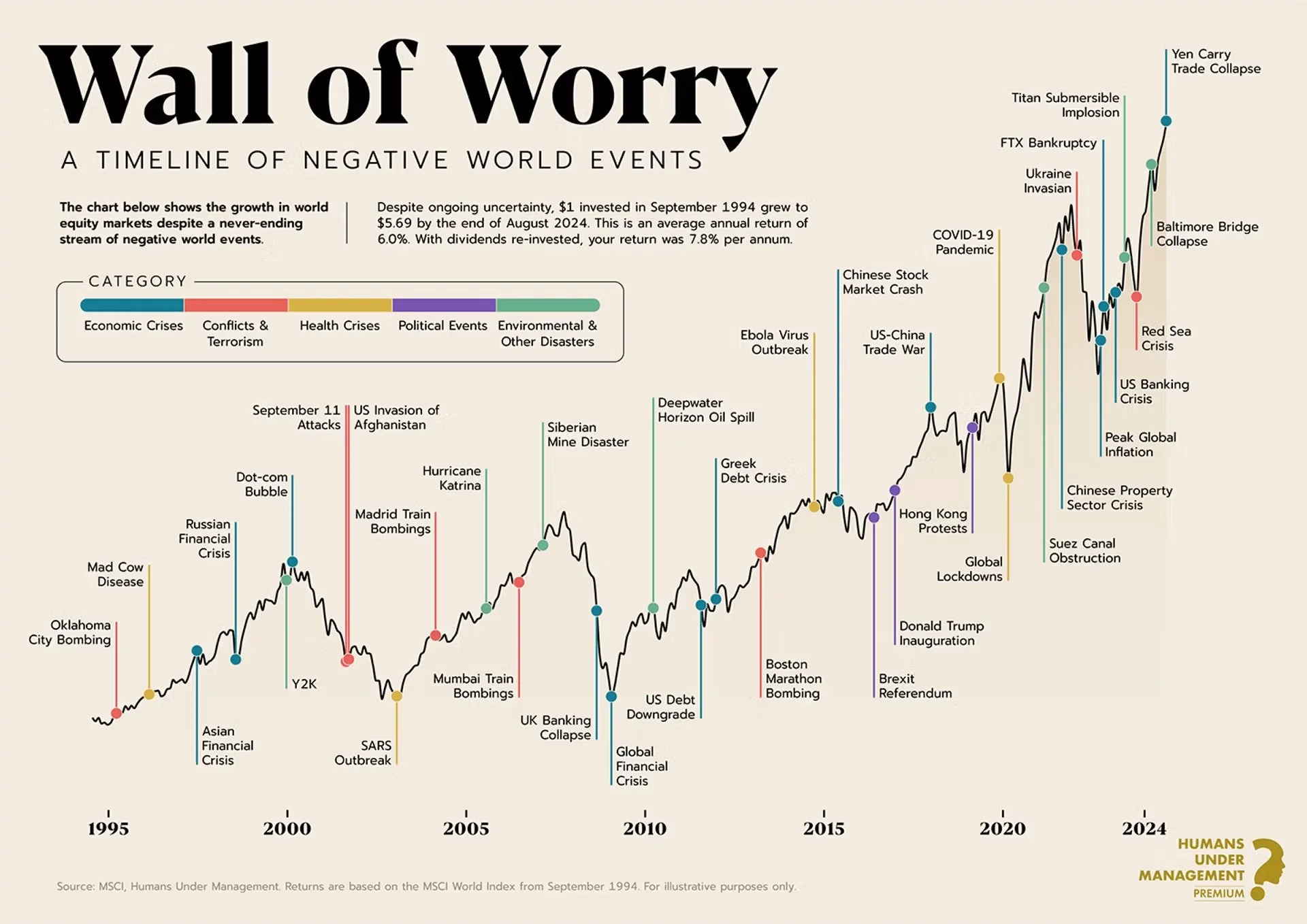

If news headlines scream “crisis,” we forget that markets have recovered from countless crises before.

In short, recent memories crowd out long-term lessons.

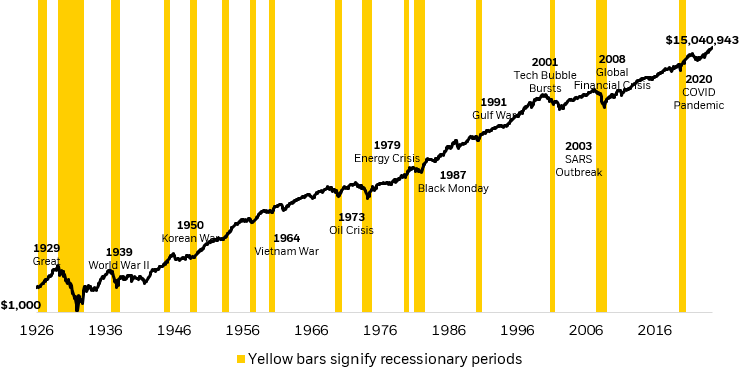

What History Teaches Us

Recency bias isn’t just a theory—it has cost investors real money. Here are a few examples:

2009 Misremembered: After the financial crisis, many investors thought the U.S. stock market had been flat or negative in 2009. In reality, the S&P 500 gained +26.5% that year. Those who stayed out missed the recovery.

Fund Flows in Reverse: Research shows the average investor badly lags the market. Over 20 years, $1 million invested with poor timing shrank to about $800,000, while simply staying in an index fund could have grown to $2.7 million.

Sector Surprises: Real estate returned +46% in 2021—only to fall −26% in 2022. Those who piled in late paid the price.

Recent Panic vs. Reality: In 2022, inflation fears triggered $65.7 billion in outflows from U.S. equity funds. Yet in the first half of 2023, the S&P 500 rebounded by nearly +17%.

These examples remind us that markets move in cycles—and the story rarely ends the way today’s headlines suggest.

Recency Bias in Investing

How Recency Bias Hurts Real People

It’s easy to think of investing as numbers on a chart, but at JA Group we see the human side:

Families cashing out of investments during downturns—only to struggle when markets recover.

Entrepreneurs chasing last year’s “hot” sector, instead of focusing on where they have conviction and long-term alignment.

Institutions abandoning well-built strategies under pressure from short-term underperformance.

The emotional cost is just as real as the financial one. Fear, regret, and second-guessing erode not only wealth but peace of mind.

How to Break Free from the Trap

The good news is that recency bias can be managed. Here are practical steps:

Zoom Out

Look at decades, not months. Market history—going back 100 years—shows repeated cycles of downturns followed by recoveries.Stick to Your Plan

Set clear long-term goals and resist the urge to make emotional changes when markets get noisy.Rebalance with Discipline

Automatically bring your portfolio back in line with your targets. This forces you to buy undervalued assets and sell overvalued ones—countering recency bias.Limit the Noise

Too much daily news makes the short term feel bigger than it is. Focus on the signals that align with your goals, not every headline.Use a Thinking Partner

A trusted advisor provides perspective when emotions run high. Sometimes the most valuable role of an advisor is not picking investments, but reminding you to stay the course.Reflect on Past Decisions

Keep a journal of why you made each investment choice. Looking back helps you see where recency bias influenced you—and how you can do better next time.

The Bigger Picture: Wealth with Purpose

Overcoming recency bias isn’t just about earning higher returns. It’s about building wealth that lasts—wealth that serves families, communities, and generations to come.

If you want to avoid the common pitfalls in investing and growing your wealth, get in touch to learn more about our Advisory Service.