Is the Stock Market Really Too Expensive? Here’s What You Need to Know

At JA Group, one of the questions we hear regularly from clients is: “Isn’t the stock market overpriced right now? Should I be worried about a correction?” It’s a fair question, given the headlines and the talk about high valuations. But instead of reacting to news, what matters is understanding the context, keeping a long term lens on your investments, and staying aligned with your goals. That’s what we want to walk through today.

Why Do We Fall for Recency Bias?

Yes, by some metrics, stock prices appear higher than what we’ve seen historically. But “higher prices” on their own don’t tell the full story. Imagine you’re buying a home. If the price is higher than last year, your first thought might be: “Is this too much?” But what if that home is now larger, with higher-quality materials, a better location, or improved amenities? Then the higher price could be justified. The same logic applies to companies; if their earnings are growing, if they are expanding, innovating and becoming more efficient, then a higher valuation may make sense.

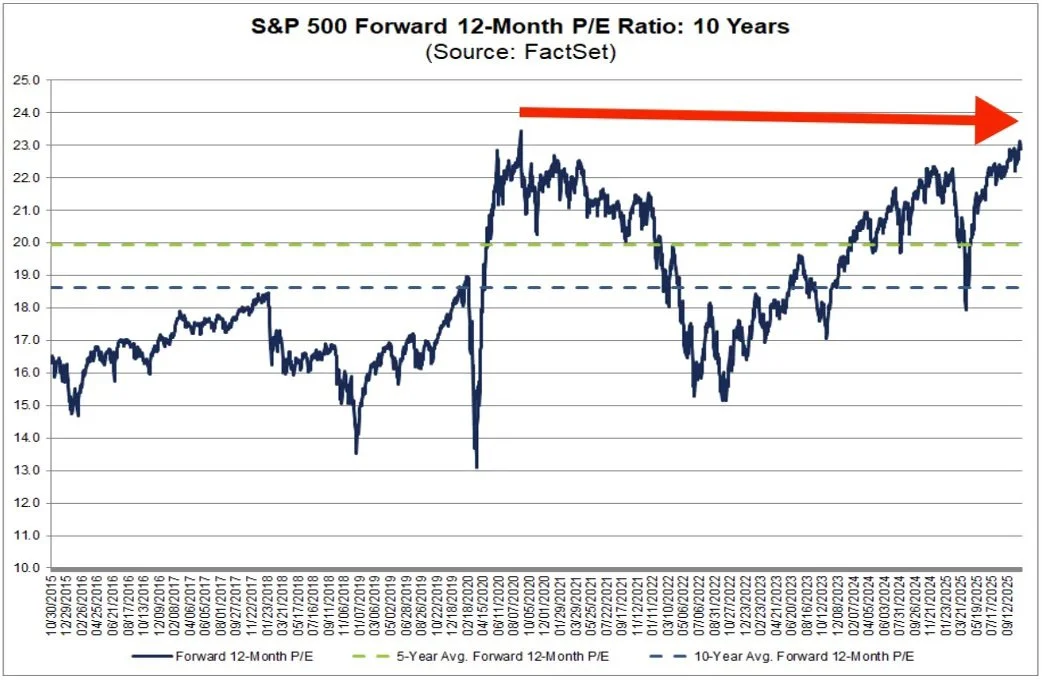

This chart shows that stock market valuations, measured by the forward price-to-earnings ratio, are currently above their 5- and 10-year averages. While this suggests stocks may be “expensive” relative to recent history, it doesn’t necessarily signal an imminent correction. Valuations often reflect investor expectations about future growth and earnings strength.

What this shows is that valuations have sometimes been much lower, and sometimes much higher. The key takeaway: valuation alone doesn’t tell you when a correction will happen, but it does say something about the starting point for future returns.

The Role of Earnings Growth

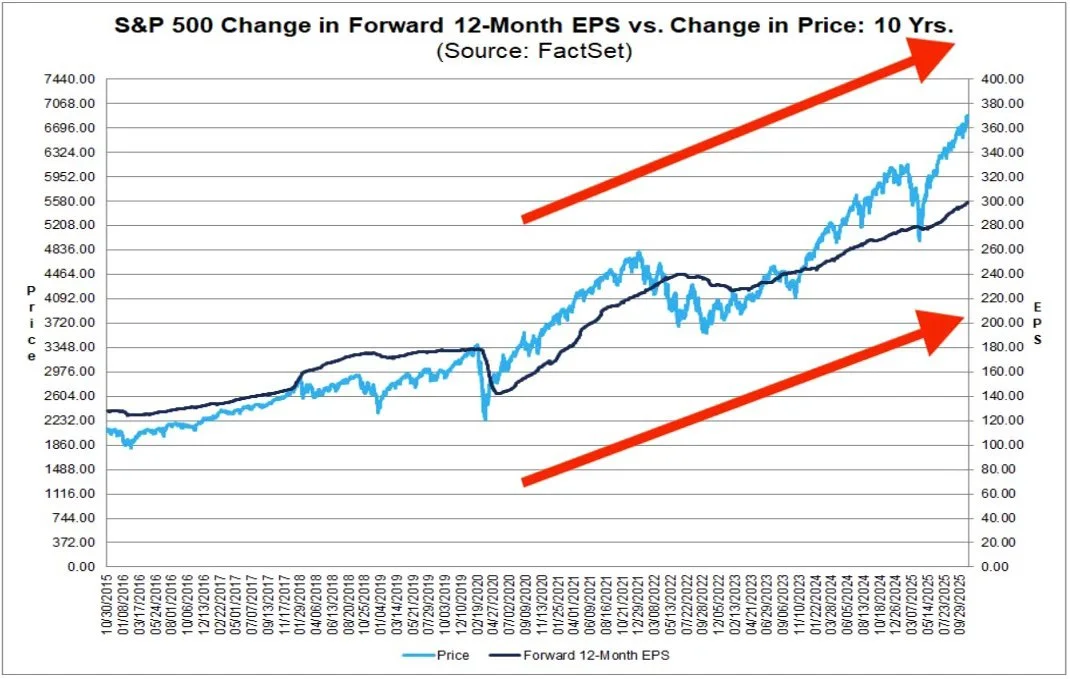

Another chart helps illustrate why “high valuation” is only one piece of the puzzle, because if earnings (the “E” in P,E) grow meaningfully, what looks expensive today may be less so tomorrow.

This chart compares stock prices with company earnings growth over the past decade. Notice how the market’s upward movement has broadly followed a similar upward trend in forward earnings. This is a helpful reminder that price increases can often be supported by real underlying growth, not just speculation.

What this means for you: The value of investing isn’t simply about “how cheap or expensive” the market is today, it’s about what you’re getting (growth, stability, diversification) and how long you stay invested. A higher valuation may mean future returns are more modest, but not zero.

Why Timing the Market Doesn’t Work

It’s tempting, especially when valuations are elevated, to try to “time” the market. Sell now, wait for the dip, then get back in. Here’s the thing: research consistently shows that trying to pick the exact top or bottom is risky, and for most investors, sticking with your plan wins out.

Consider the impact of missing just a handful of the very best days in the market. Even if you sat out for what seems like a “reasonable” pause, you could miss the handful of big up days that drive much of the long-term return.

Instead of saying “when will the correction come?”, we focus on: “How can we structure your portfolio so it’s positioned for long-term growth, whatever the short-term volatility?” That means staying invested, diversified and aligned with your timeline and purpose.

What Matters More Than “Is the Market Too Expensive?

So, instead of fixating on whether the market is overvalued, we encourage our clients to consider these four guiding questions:

What are you investing in?

Whether it’s retirement, building a legacy, or funding philanthropic or family goals, the purpose drives your strategy, not the headlines.What’s your time horizon?

If your investment horizon is 10, 20 or 30+ years, temporary mis, valuations matter less. The power of compounding and staying invested becomes your friend.Are you diversified?

It’s one thing to invest; it’s another to invest with intention. Diversification across asset types, geographies and strategies helps manage risk and capture opportunity.Are you acting from discipline, not emotion?

Elevated valuations raise awareness, but they don’t necessarily change your plan overnight. Market cycles come and go. Your plan should stay rooted in your objectives, not reactive to fear.

The Bottom Line

Yes, the stock market may look “expensive” by historical measures. But expensive is not the same as doomed. What matters more is how your portfolio is positioned, your time horizon, your diversification, and your discipline.

At JA Group, we’re here to help you navigate that journey with clarity, calm and confidence. If you’re wondering how your portfolio is set up for the long run, or how you might adjust in light of current valuations, let’s have a conversation. Your future matters too much to leave to guesswork, get in touch to learn more about our Advisory Service.